The Payment Service Provider (PSP) NexGen

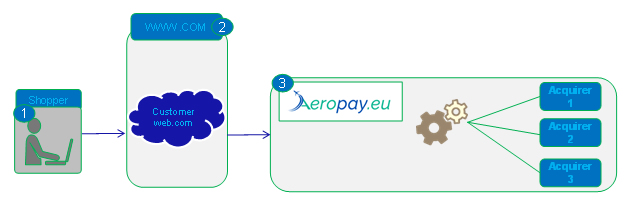

Aeropay Payment Service Provider (PSP) enables the connection between an online booking and online-shops and other market participants such as banks or credit card acquirers. Through this, the costs for the integration and processing of different payment methods are significantly reduced. The profits from services such as Risk Management, Reporting or Fraud Protection and, in addition, is relieved from the safety requirements of the card industry. Furthermore, the Aeropay UG provides the possibility of offering multiple currencies.

Aeropay offers various services concerning electronic payment acceptance and integrates different payment methods such as e.g. credit and debit cards, bank payment, e-banking and e-Wallets. Aeropay UG is not bound to an Acquirer or a payment network. This allows the integration of several different national and international payment methods over just one matching point – Aeropay UG.

The advantages in an overview:

- Easy adding of new payment methods which leads to more orders and more revenue

- Reduction of integration and processing costs

- Risk reduction for the online shops concerning security and lost revenue due to the implementation of address and credit controls

- PCI-Compliancy. All companies who process, save or forward credit card data must be PCI-certified. By having a contract with Aeropay UG and the matching payment module customer can save itself the costs for a certification.

Cost structure

Aeropay of course charges a premium for this service. Generally it is put together as follows:

- A piece one-time set-up fee

- A monthly fee for the provision of the services

- Pricing on-demand flexibility

Aeropay provides a future orientated payment services such as Credit Cards, e-Wallet, Mobile-Pay and different payment channels.

The Processing steps:

Join us!